Southwest Airlines Magazine

At age 13, in the mid-sixties, Dallasite Jody Tallal was cooking 12-cent hamburgers at a joint on Lemmon Avenue. At 14, he was scooping ice cream for Baskin-Robbins. At 15, he was assistant manager of a drive-in movie theater. At 16, in 1969, he was selling memberships in an entertainment, dining, and travel club; by the time he graduated from high school, he was making $300 a week-about $15,000 a year-at the same club.

At age 13, in the mid-sixties, Dallasite Jody Tallal was cooking 12-cent hamburgers at a joint on Lemmon Avenue. At 14, he was scooping ice cream for Baskin-Robbins. At 15, he was assistant manager of a drive-in movie theater. At 16, in 1969, he was selling memberships in an entertainment, dining, and travel club; by the time he graduated from high school, he was making $300 a week-about $15,000 a year-at the same club.

At 19, Jody was on the dean's list in college and making $25,000 a year working part-time at the entertainment/travel club. Realizing, after four years in college, that his business management degree would "guarantee" him no more than a $12,000 salary, he said good-bye to higher education. At 21, he was a division manager for the entertainment/travel club and making $38,000 a year. That same year, he left the club to take a $42,000-a-year job at a national real estate referral company in the St. Louis area

At 22, he quit the real estate firm to take a position in Dallas as a financial consultant apprentice for a six-month period. During the apprenticeship, he earned no salary, no commissions, no income. At 23, he became a paid member of the firm. At 27, he started his own financial consulting firm.

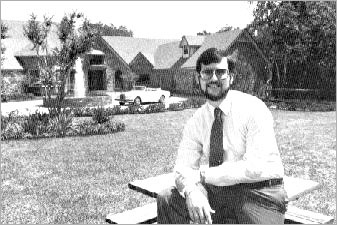

Today, at 33, Jody Tallal is a financial manager to clients who make at least $150,000 (that's the bottom; higher incomes are preferred). He charges $5,000 for a two-day financial review, or about $300 an hour. A year ago, he was worth $7 million; now it's "significantly higher." He plans to be worth $40 million in eight years-when he's 40. His personal success, he's quick to point out, is merely a reflection of the success his expertise and procedures have brought to his clients.

Obviously, Joseph J. Tallal, Jr., is no ordinary guy. But what built the fire under him? What made him strive for the top of the mountain?

"When I was seventeen," he answers, I read a book called "I Can" by Dr. Ben Sweetman. It was a Norman Vincent Peale type of motivational book. It really just said that you can do what you want to do. It said that if you set goals and use the book's philosophy, your goals will become reality.

"Dr. Sweetman's philosophy and procedures worked one-hundred percent for me. Through the book, he told me what to do, and I did. Then my goals began to be realized, one by one. The book presents a very interesting scenario. You just pretend things you dream about have become real already. You daydream about them, and you think about them on a regular basis. If you want a car with a mobile telephone in it, you just daydream about driving it around. Then, four or five years later, seemingly by accident, you will find yourself driving a car with a mobile phone. It all seems to happen mystically. Dr. Sweetman's premise is that the subconscious mind is continually working toward the goal, guiding you in that general direction without your thinking about it. The premise worked to perfection for me."

Still, it should be made clear that young Jody Tallal wasn't shy of spunk or moxie or whatever they called it in the 1960s even before he read the good Dr. Sweetman's book. How he got the job at the entertainment, dining, and travel club demonstrates that. He saw an ad in a newspaper, looking for young people to sell memberships for this club. The ad said you had to be 18. Jody was only 16, but he headed down there anyway. When he walked in the office, the man behind the desk said, "Are you going to lie to me and tell me you're eighteen or should I stop you before you do?" Jody said, "I didn't know if you were interested more in somebody who could do the job or in their age." The man looked at Jody and replied, "Okay, big mouth-you got a week."

Still, it should be made clear that young Jody Tallal wasn't shy of spunk or moxie or whatever they called it in the 1960s even before he read the good Dr. Sweetman's book. How he got the job at the entertainment, dining, and travel club demonstrates that. He saw an ad in a newspaper, looking for young people to sell memberships for this club. The ad said you had to be 18. Jody was only 16, but he headed down there anyway. When he walked in the office, the man behind the desk said, "Are you going to lie to me and tell me you're eighteen or should I stop you before you do?" Jody said, "I didn't know if you were interested more in somebody who could do the job or in their age." The man looked at Jody and replied, "Okay, big mouth-you got a week."

The week turned out to be four years. At the end of them, Jody was earning $42,000 a year. He was just 20 years old, and he was driving a Lincoln with a car phone installed inside it. He was also driving a Lotus sports car. He was wearing custom-made clothes, living in a swanky house, and taking trips to Europe or anywhere else in the world he wanted to go.

But then Jody did something quite unexpected and mysterious. He quit the job to work somewhere else for no money and no sure prospects of a future.

Why did he do that? He explains it like this: "I got the opportunity to go back to Dallas and study to be a financial consultant. I sat down and examined my life. That's when it dawned on me that I didn't know anything about money except how to make it."

"I looked at my savings account book, and there was $3,000 in it. I realized that if I was making $42,000 a year and had that little money in savings, by the time I was forty years old I'd be making $100,000 and have $6,000 in savings. And I'd always be waiting for next week's paycheck to keep going for another week.

"My own financial insecurity at that time, plus the fact that the financial consultant who wanted to teach me everything he knew was worth $7 million, made up my mind for me. I decided I needed to understand the concepts of making money make money. I knew how to make money-I just didn't know how to do anything with the money I made. So I packed my bags and headed to Dallas to learn."

Jody's training was intense. He soon resembled a sponge, soaking up all the aspects of the financial-consulting business, including lots of practical experiences with taxes and legal matters. The business was something he took to as naturally as money to a vault. And now, for a price, he passes on what he knows.

"I take a person's goals or objectives and I consider their income and environment," he explains. "Then I program out how to make those goals real. If they want to send their child to Duke University for five years and it costs $10,000 a year, I plan how they're going to get that money delivered to them at the lowest tax base or delivered to their children at the lowest tax base. If they want a retirement income, I plan the best route for them to use to reach that goal. As a result, I manage their environment. So I'm more than just a financial consultant."

Jody's philosophy, which has reaped considerable dividends, is this: The basic truth behind financial management is to understand an income as a defined substance. A pie, for example. He uses a pie graph, and he depicts a given income as a pie. Every single thing a person wants or needs is a slice out of that pie. A certain life-style is a slice. So are taxes, insurance, education. When one makes a financial plan, one goes to the pie and cuts off a slice for each need or want. If one cuts out more slices than one has pie, one's dreams exceed one's current capabilities.

Says Jody, "When that happens, it's time to determine what levels of compromise are necessary and in what areas it win be necessary to compromise. The end result is that you want a pie where all the slices fit. That way, you know you'll get the things you want. I can program wants and needs as a dollar-and-cents figure. Every objective a person has can be equated to a price tag. It doesn't matter whether you're a plumber making $30,000 a year or a neurosurgeon making $300,000. Every goal has a price tag. When you go into a store to buy a video recorder, the price doesn't change according to your profession. My philosophies and procedures work just as well for plumbers as they do for neurosurgeons."

For the work he does, Jody prefers the title "financial manager" to "financial consultant." He feels that while there are lots of financial consultants about, the service he renders is qualitatively different from theirs. "The difference," he specifies, "is, my clients come to me with the specific objective of having someone manage their environment. What I do is similar to the business managers of Hollywood celebrities. A celebrity-an actor, let's say-who's made a tremendous sum of money in a short time usually has no expertise, no experience-he really doesn't know anything about money at all, other than the fact he's got a bunch of it coming in. That's basically the situation I was in ten years ago, and it's the position almost anyone who makes a lot of money finds themselves in. That's because none of us is trained in how to handle money."

Jody Tallal has charted his own course and the course of his clients with a tremendous amount of success. When he says he has the power to better your financial life, you just about have to believe him. Maybe that's because he believes in himself so much.

Reprinted from Southwest Airlines Magazine