News and Publications

Tallal’s Tips

A Publication by Joseph (Jody) Tallal, Jr.Volume XX, Number 4

November, 2 2008

The Fourth Turning – Final Thoughts

It has now been over two and a half years since I wrote the first three Fourth Turning newsletters published between April and June of 2006. In light of the major upheavals in our country over the last several months, if you haven’t already, you might find it valuable to go back and read this series again to see how its message now resonates compared to the first time you read them.

![]() www.tallal.us/news/FourthTurning1.htm

www.tallal.us/news/FourthTurning1.htm

![]() www.tallal.us/news/FourthTurning2.htm

www.tallal.us/news/FourthTurning2.htm

![]() www.tallal.us/news/FourthTurning3.htm

www.tallal.us/news/FourthTurning3.htm

The purpose of this final installment to this Fourth Turning series is to assess where we might be with regards to this topic and explore potential options of what one might consider doing next. However, before I begin, I wish to reemphasize what I have said in the previous three newsletters on this topic: This newsletter series is not my prediction of what will happen; it is just information worthy of your understanding so you can be more informed about history and how it might relate to our future.

Understanding history does not mean it will repeat itself again, however, it has also been said that failing to learn from history means we are doomed to repeat it. Therefore, the real goal is merely to understand as much as we can, so we can proceed with as much knowledge as possible in these turbulent times.

Please also know that I do not claim to have a crystal ball, or feel that I know any more or less about what the actual future holds than do you. The purpose in writing this series has been with the hope it might accomplish the following three things:

|

Therefore, nothing contained in any of the newsletters in this series is intended to advise you what you should do, but instead provide food for thought with the hopes of expanding your potential horizon on this matter. Ultimately whatever makes sense to you is exactly what you should do.

If you recall from the last issue, I visited with one of the authors of The Fourth Turning concerning a supposition I had as to the real date a Fourth Turning actually begins.

My question to him once again is below:

“When in history did each past Fourth Turnings actually begin? Did the last one begin the day of the stock market crash in 1929, and the previous one to that, the day the Civil War broke out? Analyzing your theory, that would not appear to be the case. Wouldn’t a Fourth Turning have already occurred for the above described catalyst to be able to trigger its unfolding? Wouldn’t things in a society have to have already deteriorated to such a point that the catalyst was simply a flash point from which that Fourth Turning becomes most evident? The events leading up to the stock market crash, and how people responded to it, are what allowed it to manifest into the Great Depression and subsequently WWII. The same is true of the Civil War, American Revolution, etc. Would not the system have to already be deeply skewed for a catalyst to be able to manifest the outward results of a Fourth Turning? The reason for these questions is I am curious if our Fourth Turning has in fact already begun and simply waiting for the right catalyst to become overtly obvious. The most striking part of our problems today is the absolute corruption of our political system, which affects every part of our lives as Americans. Congress no longer represents the people. There is no level of common sense left in Washington and they uniformly see themselves as above the people, not subject to the same pension plans, rules, benefits, or for that matter, laws. For example, would the handling of the illegal aliens issue and the FBI seizure of Congressman Jefferson’s files (and subsequent responses from President Bush, the Attorney General, heads of the FBI and CIA, etc.) have been the same in the 1950’s, 60’s, 70s, or even 80’s? It appears our nation is deeply divided over core beliefs and philosophies. Additionally, it seems safe to suggest that in our lifetimes we have never seen such polarity across the board on so many issues. The last couple of elections where split down the middle, with each side 180 degrees diametrically opposed to the thoughts and beliefs of the other. The depth of this cavern is so immense that neither side can even discuss the other’s point of view. Each demonizes the other’s thoughts and feelings with a rabid intensity that precludes logical discussion. How can such intelligent people on both sides of an issue be so vehemently different on fundamental issues that they simply can not even communicate? This would appear to be the epitome of the very foundation needed to trigger a Fourth Turning.” |

Mr. Neil Howe was kind enough to answer my inquiry with the following comments.

“On the specific question you asked, yes, it can always be said that each old era “contains” the new era within it (so to speak) otherwise how could the new era be born? George Will once famously observed that “the 1950s was pregnant with the 1960s.” And, I suppose, we all know what he meant by that—culturally, socially, and generationally. Taken to its extreme, however, the incubatory perspective means that no new era ever really begins, going back to the beginning of time. This can’t be right, either. From our perspective, a new turning begins when the potential becomes actual, when what is earlier hidden (however obvious) becomes outwardly apparent, when society’s direction if not yet its position dramatically alters. It is in this sense that 1929 or 1860 or 1773 can indeed mark the beginning of new eras. Yes, gas filling a warehouse may be a necessary precondition for a conflagration, but that precondition is not yet the event. Someone has to touch it off with a match. That is the catalyst, which may in itself be a random event but which begins the unfolding of a new dynamic (“regeneracy”) unique to Fourth Turnings. But history is never predetermined. Until the match is struck, no one can tell how (or even if) the Fourth Turning will unfold.” |

Mr. Howe’s grasp of this issue is obviously far superior to mine. What I take from his comments is that there is no Fourth Turning until a catalyst ignites the tender box. I also take from his analogy that striking a match in an empty warehouse will not trigger much more than the fire at the end of the match tip. However, if you have a warehouse filled with gas, it takes very little to set the whole thing off.

Regardless the percentage odds you previously predicted that a Fourth Turning might occur two and half years ago, based on what you have seen occur since then, at what do you now place those odds?

Two and half years ago, all we knew was that we had a warehouse full of gas, but no match had been struck, and no one was visibly playing with any matches near it. However, the $64 million question now becomes whether you feel the recent subprime mortgages debacle, resulting in the subsequent $700 billion bailout rushed through by Congress; followed by a massive meltdown of the stock market; followed by the democrats successfully laying the blame for this debacle on the “failed economic policies” of the Bush Administration which enable them to sweep both the House and Senate and secure the presidency for Obama; qualifies as a lit match?

For my own perspective, where I had original felt there was a 15 - 20% chance of a Fourth Turning occurring in June 2006, I am afraid that those odds have now jumped significantly (if in fact a Fourth Turning hasn’t already begun).

So the next question is at what point would you really know if a Fourth Turning was already underway? If you look back to 1929, the day the stock market crashed was only the catalysts that started the process. The country did not plunge into a massive depression over night. It took a series of several other events and significant time elapsed before a recession became an all out depression.

Just like the first snow of winter doesn’t reveal anything about the severity and duration of the upcoming winter, attempting to conclude that the recent market meltdown allows us to gauge anything substantive at this point is equally premature. Therefore, again the question becomes when will we know if we are indeed in a Fourth Turning?

It is my supposition that by the time you can conclusively determine that we are in one; much valuable ground will have been forfeited. This is similar to people who waited until they heard news that the banks where failing before deciding they needed to withdraw their money. For them, by the time they got to the bank to withdraw their money, it had already vanished. Decisions made now after the facts, like then, will probably yield similar disastrous results.

For example, if you had already determined a couple of years ago that there was ample reason to start moving some of your growth oriented investments into cash and/or gold, and then increased that ratio as the economic climate worsened, the impact of what has happened over the last 90 days was probably not very significant for you.

If you instead waited to take any action until three months ago when you saw the markets begin to collapse to conclude that this might be a sign for you to significantly withdraw from the market, you would not have fared as well as the above example, but certainly better than if you instead stayed in and are now attempting to ride it out.

The facts are that nobody knows what will happen next. The market may come roaring back to 11,000 and move up to 12,000, or it may plunge down to much lower levels on the next sequence of surprise bad economic news.

But that is not the point here. The real point is to determine whether or not you believe there is any chance that we might be entering or will have a Forth Turning, and if so, determine what odds you currently place on that possibility. Once this is determined, this is the percentage of your assets that should place in a contingency plan outside of the reach of market fluctuations.

You goal is not to make money on these assets, but instead to protect and preserve them. This is an insurance fund and its premiums are the lack of potential growth you might have been making if you kept these assets invested and at risk.

If at this point you do not feel there is any real threat of a Fourth Turning that justifies your concern, then the remainder of this newsletter might be a waste of your time to read. When I first read the Fourth Turning, I had to really grapple with accepting it as anything other than just another doomsday prophecy. In the past, anytime I read something that predicted a major upheaval that was outside my ability to change, I immediately pigeon holed it as a doomsday prophecy, and as such, it was easily dismissed.

However, as I continued to read the Fourth Turning and continued to better understand our history, Saeculums, and Turnings, along with the authors’ theories as to their cause, the less I could pass this off as just another scare book. For me, finally seeing the fact that I so badly wanted to dismiss this because I could not bear the thought of it ever occurring, became the catalyst for being able to break my denial and start approaching the subject as a real prospect and then planning accordingly.

Unfortunately, for me, things have recently gone way past this point now. We all know that we have been witnessing things occurring in the markets and government over the last few months that we have never seen in our lifetimes. For me, things have reached a point that I can no longer pretend that a Fourth Turning is not probable.

So the next challenge in my ongoing denial has been at what point I should stop thinking about this as a possibility and actually start accepting it as an increasingly probable reality. In other words, if I were planning for such an event in stages and had already implemented a Stage 1 plan based on past events, when should I consider implementing Stage II and Stage III planning?

As the events of the last 90 days have unfolded, this question has occupied a lot of my thinking. Many of you know that I have been extremely consumed building my Internet business as well as trying to liquidate my clients’ real estate holdings. Most evenings I find myself working past midnight focused on building a brighter tomorrow.

Yet over these last few months I have had this repeating thought of “What good is it to have researched the potential of a Fourth Turning, if I just sit by and do nothing until it is too late. Again the paralysis of denial has been a major obstacle to overcome.

A couple of weeks before Washington Mutual (where we have a lot of our liquidity) went under, I heard the first words of it potential failure. When I initially heard this, the thought ran through my mind that I needed to move my money to another bank, but I failed to do it. Then several times over the next several very busy workdays, I thought about it again. Yet somehow each time I convinced myself I had plenty of time because I had just heard about its problems, and a bank this large would not fold overnight anyway.

After a few days, I started asking myself how I would feel if this bank really did go belly up. Since I had already been studying the impact that a series of major banks failing might have on the banking system, I was able to finally overcome my sense of denial enough to actually go and withdraw my money. Within days after that, WAMU went bankrupt. Fortunately, Chase took them over, but that did not occur until after WAMU went under.

Recently Dick Armey wrote:

What will be the fate of free market capitalism in America? Will the 2008 election look more like 1932 -- or 1992? On both occasions, Republican presidents had abandoned their party's principles for bigger government policies that exacerbated difficult economic times. On both occasions, Democrats took control, largely hijacking the small-government, fiscally responsible rhetoric of their opponents. Of course, FDR's election ushered in the New Deal, the most dramatic expansion of government power in American history, together with policy changes and economic uncertainty that inhibited investment and growth and locked in massive unemployment for nearly a generation. The official agenda of the incoming administration is not so different from FDR's. Whatever doubts remain about Mr. Obama's governing principles can be cleared up by looking at the governing philosophy of the Democrats in Congress he will be crafting legislation with or the liberal constituencies he is indebted to support. Democrats will not be ambiguous. They have every right to be energized, and will attempt sweeping changes to our economy and the very nature of the relationship between individual American citizens and the federal government. Their wish list is long. Charlie Rangel, chairman of the House Ways and Means Committee, has said he would like to redistribute a trillion dollars through the tax code, including massive tax hikes on capital accumulation and individual entrepreneurship. Labor unions want to take away the right of a worker to a secret ballot in organizing elections. Radical environmentalists demand strict curbs on energy production and use. Hillary Clinton may have lost the primary, but expect Democrats to push her favorite idea: government-run health care. |

Mr. Army’s thoughts go directly to the heart of the matter. However, they do not look at this through the filter of an overdue Forth Turning.

Consider the stock market crash of 1929. Things did not crumble on that day. What took what should have been a recession, and made it into a depression was the way we handled the forth coming events.

As people lost more and more jobs, and investments evaporated for the vast number of Americans, their fear brought them to the conclusion that the government was their only salvation. Yet it still took three years before they elected FDR on the promise that the government would fix the problems.

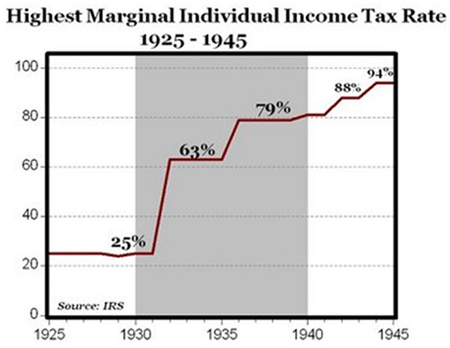

At that time we had been in a severe recession. It was and spiraling tax increases from Hoover the subsequent massive government spending ushered in by FDR’s New Deal that turned the recession into such a deep depression that World War II was the only thing that could put Americans back to work (either as soldiers or manufacturing what the soldiers needed). Below is a chart of what happened to income taxes during that period which had a significant impact on the attempted recovery.

Yet here we are again, but this time it didn’t take 3 years to elect an FDR who promised the government would help everyone, we did it 3 months after the crisis became a reality on Wall Street. Additionally, we gave this new President elect a completely liberal House and Senate which means there is little opportunity to slow the inevitable.

The Big 3 auto makers have already requested their bailout as other major corporate lobbyist are flooding Washington demanding help for their clients as well. They are all threatening devastation to the economy if they too are not bailed out. What was a $700 billion bailout a couple of months ago, in now estimated to take $3 trillion to fix the problem, and climbing? Also, let’s not lose sight that $700 billion is enough money to completely rebuild the nation’s infrastructure of road, bridges, electrical grids, etc.

So what do you do now with our planning process? The challenge still remains that we do not know if the dollar will implode or explode in value. Unfortunately, what is the right thing to do in one scenario is the wrong thing to do in another.

There is an increasing likelihood it could do both. Currently the value of the dollar is rising rapidly. This is not because the US economy and balance sheet are strong; it is simply that the rest of the world is worse. Money is flowing to the dollar because the perception is that the US government is more stable than others around the world. Yet this too can change rapidly.

A March 2008 memorandum to the FDIC Board of Directors shows a 2007 year-end Deposit Insurance Fund balance of about $52.4 billion, which represented a reserve ratio of 1.22% of its exposure to insured deposits totaling about $4.29 trillion.

This report was well before the current melt down, Congress increased the FDIC limits on insured accounts from $100,000 to $250,000 (a 250% increase), and FDIC insurance being extended to insure Money Market accounts. As of September 2008, the FDIC Depositors Insurance fund had dropped to only $45 billion.

Now everyone knows the FDIC is really backed by the full faith of the federal government, but where do the dollars come from to pay for all of this? One place we are reading it will come from is off the backs of the wealthier tax payers. Yet the amount collected in 2007 from all individual taxpayers was only $1.125 trillion in total. People who made over $250,000 a year were only a portion of those funds.

If large banks did in fact begin to collapse, how would the government cover this exposure? The answer is the only way they can; by printing hundreds of billions of dollars in new money.

The definition of inflation is an increase in the supply of money without a corresponding increase in goods or services on which to spend that money. Thus, if there is a finite supply of goods and services, the prices for these goods and services are established based on the current supply of existing money. However, if the supply of products and services remains the same and the market is then flooded with billions of new dollars printed to finance these current bailouts, as this money flows into the market, the cost of everything in turn will begin to skyrocket.

According to Wikipedia, “The main cause of hyperinflation is a massive and rapid increase in the amount of money, which is not supported by growth in the output of goods and services. This results in an imbalance between the supply and demand for the money (including currency and bank deposits), accompanied by a complete loss of confidence in the money, similar to a bank run. Enactment of legal tender laws and price controls to prevent discounting the value of paper money relative to gold, silver, hard currency, or commodities, fails to force acceptance of a paper money which lacks intrinsic value. If the entity responsible for printing a currency promotes excessive money printing, with other factors contributing a reinforcing effect, hyperinflation usually continues." |

The extreme of what this can look like was Germany in 1923 when it literally took a wheel barrel full of bills just to buy a loaf of bread. Before that debacle was over with, money had become so worthless that women were literally burning money in the winter just to keep their children warm.

The money for the recent $700 billion bailout, which is only the first phase of this crisis, has to come from somewhere. Obviously, the government cannot just double everyone’s taxes at a time people have lost their life savings, and many of them their jobs. The probability of a rapid inflation is strong unless we collapse into massive full scale devaluation all at once first. In order for that to happen, the banks would have to collapse and the government would have to refuse to print money. This would mean money would disappear and whatever was left would become extremely valuable.

The money for the recent $700 billion bailout, which is only the first phase of this crisis, has to come from somewhere. Obviously, the government cannot just double everyone’s taxes at a time people have lost their life savings, and many of them their jobs. The probability of a rapid inflation is strong unless we collapse into massive full scale devaluation all at once first. In order for that to happen, the banks would have to collapse and the government would have to refuse to print money. This would mean money would disappear and whatever was left would become extremely valuable.

Given Congress’s current disposition of an open checkbook policy, the odds for a rapid (and potentially hyper) inflation appear to be much more likely. Therefore, what grows in value during a time of rapid inflation? The answer is anything tangible that you cannot reproduce quickly. Commodities will escalate rapidly in cost, as will real estate and oil. Gold will be an exact hedge to the amount of the dollar’s depreciation.

Another interesting phenomenon that occurs during a rapid inflation is that debt becomes your best friend. To illustrate, suppose you buy a home for $600,000 and take a $500,000 mortgage against it. During a rapid inflation, your home’s value escalates dramatically as the value of your dollars is plummeting. Yet your mortgage amount stays fixed in today’s dollars’ value. If inflation jumped to 15 % per year (less than it did in early 1980), then in 5 years your home would be worth $1,200,000, while your mortgage will still be only $500,000. You should also be earning twice as much 5 years later as well (even though it won’t buy any more than today’s dollars do now). This means however, that you could pay off your home loan with 50 cent dollars, producing a real net profit.

Many people have been watching the markets nervously as they have seen their life savings evaporate. The market pundits are all saying you have to sit patiently now and wait for it to recover, because if you sell today, you would lock in your loss with no way to recover.

I have always had a problem with this philosophy, because in fact, you have already lost this money. If there are fundamental changes in your investment that change its value from when you originally acquired it, then this has to be taken into account. For example, if you bought something last year for $10 and it is selling today for $6; you have in fact lost $4. Hoping it will go back to $10 so you don’t have to book your loss is an illusion. The simple fact is that as of today you have lost $4.

Every day you own an investment, you are presented with the decision to either sell it at that day’s price, or in essence “buy” it again that day’s price by choosing to keep it. In other words, if you bought something for $10 that is now worth $6, if you chose to hold onto it, you have just decided to buy it again for $6, because you could have sold it for $6 and invested that money in something else.

Therefore, before you blindly hold on, you might want to ask yourself if the market fundamentals for this investment are the same today as they were when you decided to buy it at $10. In other words, is this still the best place for your $6, or if you look around, is there a better place? That is the real question that should guide your actions in these turbulent times. Nobody knows where this market is going to go. It may return to where it was 90 days ago or this may only be the beginning of something far worse.

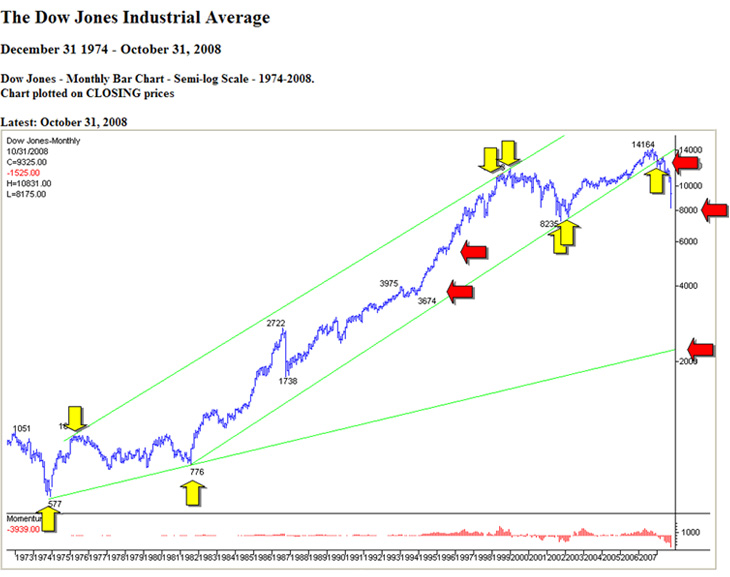

I like to use technical charts to give me some guidance when making these type discussions. Charting price movement reflects the markets previous floors of support and ceilings of resistance.

You might find the chart below of interest. It shows the DOW from December 1974 until the end of last month. The yellow arrows show touch points on the current channel lines for both the ceiling and floor during this entire period.

You will notice that there is a floor created between the two touch points in 1974 and 1982 that projects all the way to the right side around 2200. This is shown as the lower green line that has a red left arrow pointing to it in the right margin just above 2000. However, a new floor formed in 1982 (shown by the yellow up arrow pointing at 776) with new touch points in 2002, 2003 and 2007. The 2007 touch point actually broke out through the floor as you can see. This is significant, because before it broke through that floor, we had a well defined channel for the preceding 25 years.

When this broke through in 2007, the market hugged just under this floor, moving up with it until about 3 months ago, when it broke down hard through 10,000, which had been the last strong support. It then started a sharp decline to the next level of support which was 8235. Since it broke through this recently before recovering, the next two support levels would appear to be about 5500 and 3800.

Where could this ultimately end up? The new channel floor now becomes the two touch points back in 1974 and 1982, with a current intersection of around 2200. Obviously nobody knows what the market will do next, but the chart above does raise questions worthy of consideration.

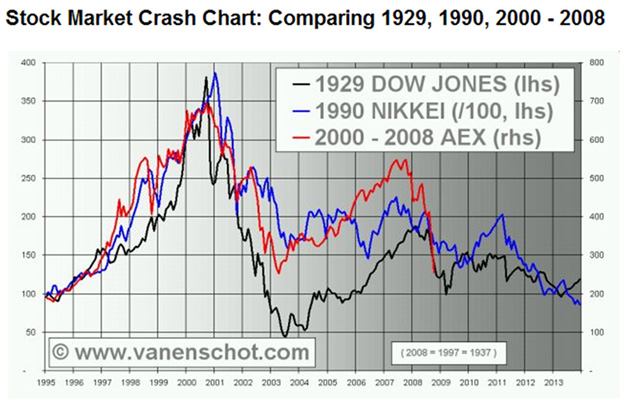

Below is a chart with commentary from www.vanenschot.com, It compares the market charts from 1929, the 1990 NIKKEI crash, and our current meltdown.

The chart shows the 1929 (Dow Jones index / US), 1990 (Nikkei index / Japan) and 2000 - 2008 (AEX index / Europe) stock market crashes and the pattern is always the same:

![]() Bubble / Boom: stocks rise more than 350% in 6 years.

Bubble / Boom: stocks rise more than 350% in 6 years.

![]() Crash / Bust: market falls more than 50% in 3 years.

Crash / Bust: market falls more than 50% in 3 years.

![]() Aftermath: markets are volatile for at least 10 years, and they end where they began.

Aftermath: markets are volatile for at least 10 years, and they end where they began.

This picture cannot be used as investment advice nor for stock market prediction and forecasting. However, these historical crash scenarios are relevant from a risk management perspective.

The next question becomes, at what point might one conclude whether this recession might be a Depression? Only time can confirm that. However, if these facts are alarming to you, you might want to start considering what Stage 2, 3, 4 and 5 planning might look like.

In my opinion, the proper way to react to this Fourth Turning potential is to take precautions today which would protect against the next step occurring. For example, 2.5 years ago, we may have only had a 20% concern that a Fourth Turn might occur. At that point, we should have evaluated the first areas of risk if things started to unravel, such as the stock market crashing, etc. As already referenced, based on this assumption, we should have removed 20% of our assets from risk in the markets. As we perceived the % of risk rising, so should have the percentage of our assets that we removed from risk.

Stage 2 planning involves looking at what a Depression might look like and taking precautions to protect against such an event. Then, if things actually deteriorated to a Stage 2 event, we would want to begin Stage 3 planning, and so forth through Stage 4, 5 and 6 (which by the way is complete anarchy and by no means what I am projecting). Obviously, any of these Stages might be as far as things gets, but if another stage is reached then the next subsequent stage of planning becomes real and necessary.

To get a better understanding of how this could look, I would strongly suggest that you read the highly acclaimed book, “The Long Emergency”, by James Howard Kunstler. This book analyzes the world’s petroleum production over the last half decade against the new demands placed on supply by India and China and projects what things would look like through a cross over point of when demand escalated rapidly and supplies drop off.

However, this is not why I recommend your reading the book. The reason it is recommended reading is that the author does an incredible job of looking at the effects of such a breakdown. He notes the massive changes that have occurred in the self sufficiency of the average American over the last century and also the changes of our country’s own level of self sufficiently during the same period.

He points out that we have lost our local farmers and retailer (as well as our personal gardens), which have all been replaced by mega farming corporations and “giga” retailers. Gone are the days of the family farm and local hardware, grocery and drug stores.

Today, everything is distributed on a national scale through regional warehouses, with the goods trucked into local Mega stores we they magically appear on the shelves for us to buy. We go into Home Depot and all of our hardware needs are in one place. The same goes for everything else from electronics to food to drugs to clothes.

But what happens if the trucks begin to stop rolling that delivering the goods. What happens if mega corporations start going out of business. How do we get what we need when the store shelves run bare? A look around confirms that this is not pure fantasy, as below is a list of store closing in just 2008:

|

The Long Emergency goes all the way from Stage 1 through Stage 6 breakdowns in each section of our country (Northeast, South, Midwest, West Coast etc.). I will warn you in advance it is not a fun read, but it is extremely well thought out and documented. Therefore, it is an excellent guide for exploratory thinking to help you develop a more successful strategic plan.

One of the first real potential in a Stage two crises could be food shortages. If companies go out of business and/or truckers go broke that move everything from the regional distribution centers to the local store shelves, things could deteriorate very rapidly until the government could mobilize to get the military to help relive the crisis. However, one only needs to look at the government’s efficiencies mobilizing such an effort on a localized level with Katrina and Ike to realize you would not want to be solely relying on that, but would instead want to be able to ride out several weeks to months on your own before things could be turned around.

Does this sound too Doomsdayish? I originally thought so after initially reading the Long Emergency until Katrina hit and New Orleans fell into near anarchy within just a couple a days. Within 48 hours after the storm, police were alongside the crooks robbing the shelves of the Wal-Marts and other stores bare. I remember thinking to myself as I watched the TV coverage, “My God, this didn’t take but a couple of days to break down to near anarchy.

I also remember shopping one evening several months later in Dallas at a local supermarket chain. The first place I went to was the fresh produce section, where I noticed that there was very little produce on the shelves and everything that was there was badly bruised or old. Then I went to the can goods section which was almost bare except for some off brands and things like canned Brussels sprouts. Then it dawned on me that Hurricane Rita was headed toward Houston and was projected to come up towards Dallas (not the reason for my grocery trip that night). By the time I could find some of what I wanted, it then took me over an hour to get through the checkout line because every checkout station had ten to twelve shopping carts in them ahead of me.

If all this still seems too far fetch to image, consider what just happened last month in Iceland. Up until a month ago, Iceland was a wealthy country and its residents felt they lived in an idea country with total security. Then literally, almost overnight, their economy collapsed as a result of our meltdown. The following is a link to a Bloomberg article explaining about the immediate financial crisis which causes a food shortage crisis.

http://www.bloomberg.com/apps/news?pid=20601109&sid=aVFtDRGwcc50&refer=home

The problem was that short term credit dried up literally over night (sound familiar, it almost happened here before the Fed step in a couple of months ago), but in this case, their government was unable to fix the situation. All major economies run on short term money. Truckers borrow daily to get gas to run their operation until they make deliveries and get paid, and this works all the way up the line. Only now, no one was able to get any money to operate.

Below is a blog of Icelandic marketing exec Hjortur Smarason which describes what happened next:

It feels surreal to drive the streets of downtown Reykjavik. The banks are lit up and people are working there. The logo’s are still outside the houses. The ads are still running saying how wonderful and trustworthy the banks are. Range Rovers and BMWs are still filling the streets and the parking lots. Bankers in their suit walk the streets with heavy eye brows. There’s a strange silence. It’s like we know the system is broken, we know it’s gone, but we can’t see it. We can’t tell what’s real, what’s still there, and what are just the ghosts of yesterday, when Iceland was one of the richest countries in the world. A pale reflection of the golden age in Icelandic economy which is now going up in flames. Where’s the smoke? The world is treating us like we’re dead. Bank accounts frozen. No business without cash payments in advance. No currency can be bought. The stock market is closed (not that I have anything left there). Imports have stopped because of closed currency markets and diapers, flour, sugar and other necessities are selling out in the shops.

|

Stage 2 planning therefore might include buying a 30 – 60 day supply of freeze dried food for your family. Freeze dried food has a 25 year shelf life and can be eaten at anytime if it is latter determined it is not needed. Your plan might also include having cash and gold in your possession in case things became like in this gentleman’s blog.

Stage 3 planning considers what would happen if food shortages occurred and people could not get their basic necessities met. Urban environments might not be the most ideal environment to be living until things stabilized. In such a case, a place off the beaten path in the country, where you and your family could go, would start to become a real consideration. Again such planning would not be justified unless the Stage 2 events were well defined.

There are many other things you can begin to start thinking about as well, but since this newsletter is already too long, I will wrap it up here. The power of having knowledge is to allow you to plan at least a couple of moves ahead. Again planning is nothing more than insurance. You have already planned ahead by buying insurance in case you home or car is destroyed; you also have major medical insurance to cover health issues, and life insurance in case you die prematurely. This type of planning is nothing other than the above, and should be only viewed in that light.

The way I found my motivation to start planning was to consider how I would feel if something like this did occur and I had not planned. What it would be like to have a family depending on me and not be able to provide for their immediate fundamental needs.

On the other hand, I strongly discourage against dwelling on the potential of what a Fourth Turning might mean to you and your family, as in my humble opinion, that is a complete waste of time and energy. That is not the desired intent of these newsletters, as worrying about this will not have any productive effect. Besides, you are almost virtually assured that whatever you chose to worrying about will not occur as you projected or worried it would. My hope is that you simply begin thinking about this and take whatever steps you deem prudent.

In case you are wondering, I have recently completed my family’s Stage 2 plan. However, I am still working every bit as hard every day building my business with the full anticipation that the future will be bright.

Now, since my plan is in place; all that is necessary is to keep an eye on the economy, our government and world events for potential red flags, while I continue to focus on building my companies and their success. For me, the bottom line is I am now covered in either event, until other occurrences indicate that more planning is needed.

After the last several newsletters, I had several people ask me if I would be willing to consult with them and do their Fourth Turning planning? Unfortunately, time has not allowed me to be able to do so, so I instead attempted to answer their questions and point them to good reading material.

However, since a Stage 1 breakdown has occurred, if a Stage 2 breakdown begins to look likely, I will begin my family’s Stage 3 planning in earnest. In such event, there are definite benefits in having a community of likeminded people with similar goals.

The economies of scale of many people joining to complete Stage 3 planning together, makes tremendous sense. Cost for land and infrastructure can be shared, as well as numerous other things that would be required. If that sound of interest and would like to visit about that further, I welcome you call.

I appreciate your continued interest in this topic and hope you have found this Fourth Turning newsletter series of benefit.

Best regards,

www.tallal.us

(972) 726-9595

NOTHING CONTAINED HEREIN IS INTENDED TO GIVE ADVICE WITH REGARDS TO SECURITIES AND ANY SUCH ADVICE DESIRED SHOULD BE OBTAINED FROM A REGISTERED INVESTMENT ADVISOR