Tallal Realty Advisors

"Decades of Performance"

Joseph J. Tallal, Jr. is a renowned expert in real estate investments and began structuring real estate investments for his clients in 1975. Mr. Tallal is a contrarian and only structures new investments when he feel it is the right time to enter the market. His special methodology was thoroughly explored in an article that appeared in Dallas Magazine.

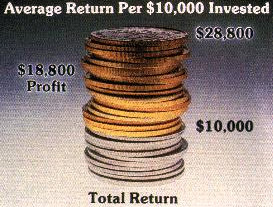

His first investment cycle began in 1975 and lasted 10 years. During this period he structured 33 investment programs that produced a before-tax internal rate of return in excess of 60%. These properties which sold for over $51,000,000 had original purchase prices totaling just over $25,000,000. Each $10,000 invested in a Tallal pre-development land investment returned $28,800 to its investors. You can review Mr. Tallal's complete track record here for this period on his real estate investments.

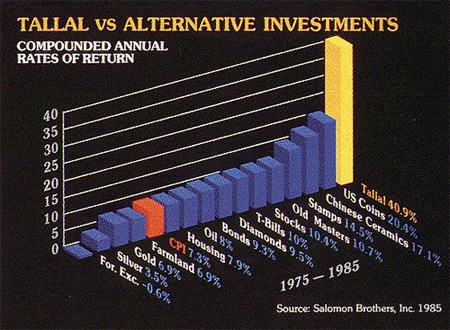

The magnitude of this performance during this period can best be illustrated by comparing Tallal's portfolio results to that of the other major investment vehicles available during the same time period. Over this ten year period ending in 1985, Tallal's portfolio had more than doubled the performance of the next best investment alternative.

Due to his contrarian philosophy, Mr. Tallal did not structure any new investments during the recession that occurred from 1986 - 1993. In 1994, Mr. Tallal began his second cycle of acquisitions for his clients which he ended in late 1997 when he felt the real estate market had heated up to a point that true investment pricing was no longer available. The second cycle of investments have performed equally as well as those in his first cycle with many having already sold and the rest being held with current market values in multiples of their original purchase price. He will calculate this cycles complete performance when the last investments have sold.

Proper execution of this strategy requires the application of many skills, both acquired and intuitive. Tallal Realty Advisors has developed seven major criteria for success in pre-development land investing. These are:

![]() Highest quality location.

Highest quality location.

![]() Proximity to major investors/developers.

Proximity to major investors/developers.

![]() Utilization of leverage.

Utilization of leverage.

![]() Acquisition with favorable terms.

Acquisition with favorable terms.

![]() Purchase with no personal liability financing.

Purchase with no personal liability financing.

![]() Determination of appropriate zoning and utilities.

Determination of appropriate zoning and utilities.

![]() Anticipation of a five to ten year holding period.

Anticipation of a five to ten year holding period.

Tallal searches out opportunities that fit these parameters when the market is right. He studies hundreds of transactions, aerial maps, and market histories, and he has surrounded himself with experts to help him develop successful investment programs.

Today, Mr. Tallal is heavily focused on the Dallas/Ft. Worth real estate market. He is waiting patiently for the market to enter a new "buyer's market" phase which he feels will make it one of the best investment opportunities in decades.

Tallal's past experience gives him the ability to create well-structured real estate programs. He special investment matrix combines the highest possible returns with the lowest possible risk.

"The profit on a land transaction occurs at the time of purchase, not at the time of sale." Joseph. J. Tallal, Jr.If you would like to find out more about Mr. Tallal's investment programs and how you can participate in the next investment cycle, please leave him an e-mail message. If you prefer to speak to him in person, he can be reached at (972) 726-9595.

For additional information, see Mr. Tallal's track record.